5 things to know before you Submit Investment proofs for tax saving

Do you know everything regarding investment proofs which you provide to your employer at the time of tax-saving season? If your answer is NO, then this article will help you understand a lot of things which you don’t know or partially know about. So, I will talk about some of the common things you should take care while giving your investment proofs to your employer for tax saving purpose.

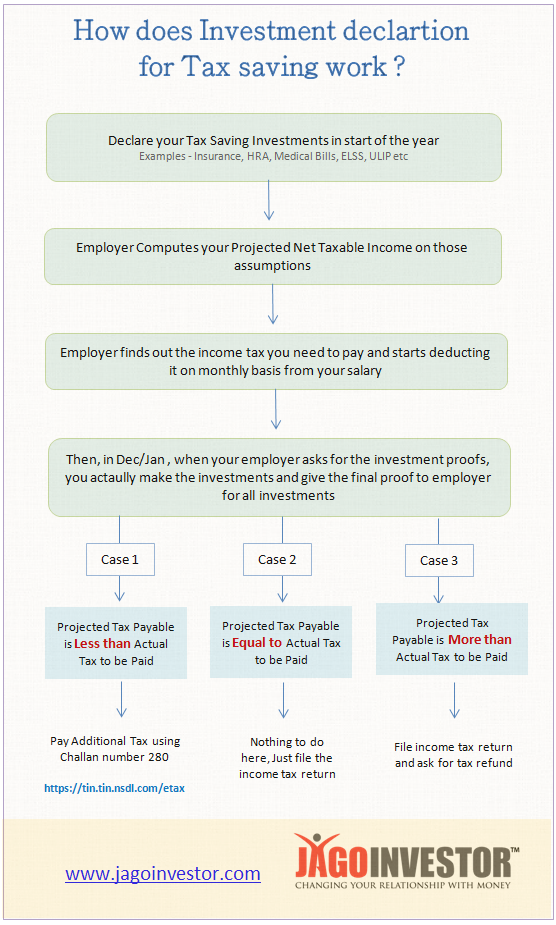

1. Investment declaration helps employer to deduct appropriate tax

The first and most basic thing you as employee should know that your employer is supposed to deduct your income tax on monthly basis and deposit it with govt on 7th of the following month. For this, the employer should calculate your taxable salary and it can only happen if you before hand give him an idea about how you are planning to save tax, and apart from that how much of HRA, LTA, Medical reimbursements you are entitled for.

For this purpose, your employer asks you to declare your various investments in the start of the year itself, so that they can compute your net taxable salary and then pay your salaries accordingly, after deducting TDS from your salaries.

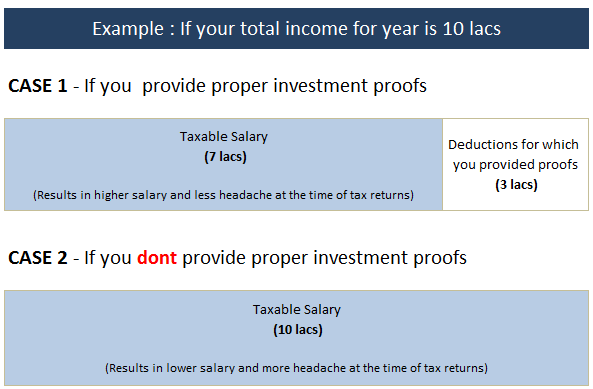

And then, finally around Dec/Jan, they start asking you to provide them the actual proofs of your investments and receipts so that they can match things with their initial calculations and if there are any difference they have 2-3 months in hand to handle the discrepancies. Below is a small example of it

What If you failed to submit investment proofs

If you failed to submit your investments proofs (you declared them, but didn’t invest in reality), in that case you are liable to pay higher income tax, but employer has not deducted it and hence they get a 2-3 months of extra time to adjust it from your salary. Following things are required by employer as investment proofs.

- To claim LTA, you need to provide Travel receipts (flight boarding pass, train tickets)

- Home loan certificates if you want to claim deductions under principal and interest repayment

- ELSS investments proofs or any other 80C investments

- Life insurance and health insurance premium receipts

- Various donations receipts

- Rent receipts to claim HRA

2. You can also share your saving bank interest, FD interest with employer

A lot of people do not know this, but you can share your saving bank interest, FD/RD interest earned during year, any capital gains from shares or mutual fund, rental income and other kind of incomes with your employer, so that they get a complete picture of your taxable salary and deduct your income tax which will be more accurate.

If you do not disclose these additional incomes to your employer, in that case – you will have to separately pay additional income tax yourself and then take these things into account while filing your income tax returns.

Note that another advantage of declaring these additional income with employer is that you will not have to pay any penalty which might arise due to not paying advance tax on time.

Also, you won’t have to take the burden of paying the additional tax at the end of the year, the tax will get distributed almost equally throughout the year.

3. Didn’t submit income tax proofs to employer? You can claim things later

A lot of investors have this myth, that if they didn’t do their investment proof submission to employer, they will never be able to claim the deductions and will have to pay higher income tax. This is not true.

Yes, it’s a good practice to give the investments proof to your employer on time, and that will save you a lot of headache later while filing the returns. But for some reason, if you fail to provide the investment proofs (example, like you don’t have money in the month of Jan and you decided to buy a life insurance policy only in Mar), in that case – your employer will deduct the income tax, but then at the time of filing your tax returns you can claim the tax refund, if you finally managed to invest in tax saving products later.

Here is a chart which will give you a better idea

Here is another detailed example of how it happens

- Ajay has the salary of 12 lacs a year, and he declares to his employer that he will invest Rs 1.5 lacs in 80C products

- Employer based on Ajay declaration will calculate that Ajay taxable salary is 10.5 lacs and will be based on that suppose the total income tax for the year is 60k (just for example) . So Ajay final salary will be 10.5 lacs – 60k = 9.9 lacs. This 9.9 lacs divided by 12 will be 82500 which he will get on monthly basis and the employer will deposit Rs 5,000 as his tax to govt on monthly basis

- Now in Jan, when the employer asks Ajay to give them the investment proof, suppose Ajay realizes that he forgot to make the investments and does not have money to invest 1.5 lacs in 80C products. But he will do it in Mar himself. And he fails to provide the income tax proofs to his employer.

- Now his employer will come to know that Ajay real taxable salary is 12 lacs and not 10.5 lacs as declared by him and lets say on this his income tax is 1 lac, so additional 40k is to be recovered from Ajay, which will be adjusted from Ajay’s salary in Feb/Mar

- Ajay then invests 1.5 lacs in Mar and finally his taxable income should be just 60k , as per the planning (because his taxable income is 10.5 lacs as declared in the start). However his employer has deducted 1 lac in total from his salary and paid to govt.

- Now Ajay can declare in his tax returns that he has invested in 80C products and he is liable to get refund of Rs 40,000 which he will get in next few months.

In the example above, you can see that not giving investment proofs on time has resulted in some inconvenience for Ajay, but that does not mean that he will lose out on his tax benefits. One can always invest around the end of the year and then claim back the tax refund later.

However, there is one exemption here

Few exemptions are made only at employer level, like LTA and medical reimbursements. So if you fail to provide LTA and Medical reimbursements proof to your employer on time, then you lose the benefit. You can’t claim it back at the time of filing returns.

4. You DONT need to submit any proofs while filing your tax returns

Another important point you should remember is that while filing income tax returns, you just have to furnish the information about your investments, and not attach any investment proof.

Please do not attach xerox copies at all. It’s not required.

Its required by the employer because they are deducting the TDS and as a third party they need the documents for verification purpose.

But if you are claiming at all the benefits yourself at the end of the year, you just need to declare things. However note that you should keep the receipts and all the required documents with you for some years, because if their is any scrutiny later, you need to be prepared to answer income tax authorities along with documentary evidence.

Which means that you should never lie about your investments which you have not done in reality. Always provide true information.

5. You need to give “proposed investment” proofs for the month of Feb and March

A lot of people are confused on how will they provide the investment proofs for the month of Feb and Mar in Jan itself, when the employer asks for investment proofs. It might happen that your life insurance premium is due in Mar or if you are doing SIP in ELSS funds, you still don’t have the statements showing the investments.

In those cases, you have to provide a declaration that you are going to make the investments for Feb/Mar and based on that declaration, your employer will process the TDS. All the employers provide you with the declaration form. You just need to write there that you promise to do the investments for tax saving in next 2 months and your exemptions should be given to you based on your declaration.

No comments:

Post a Comment