Atal Pension Yojana – Features & Eligibility explained in detail

Recently the govt has announced the pension scheme called “Atal Pension Yojana”, which is targeted at workers from lower class who work in unorganised sector which constitutes around 88% of the workforce.

An account needs to be opened under this scheme and monthly contributions needs to be made till the time of retirement after which a pension amount ranging from Rs 1,000 to Rs 5,000 per month would be paid to the account holder and on death of subscriber and spouse, the nominee will get the lump sum accumulated by the end of the period. Any person below 40 yrs can open an account.

The retirement age will be set to 60 yrs, hence one will get at least 2o yrs of contribution. Any person below 40 yrs can open an account. The retirement age will be set to 60 yrs, hence one will get at least 2o yrs of contribution.

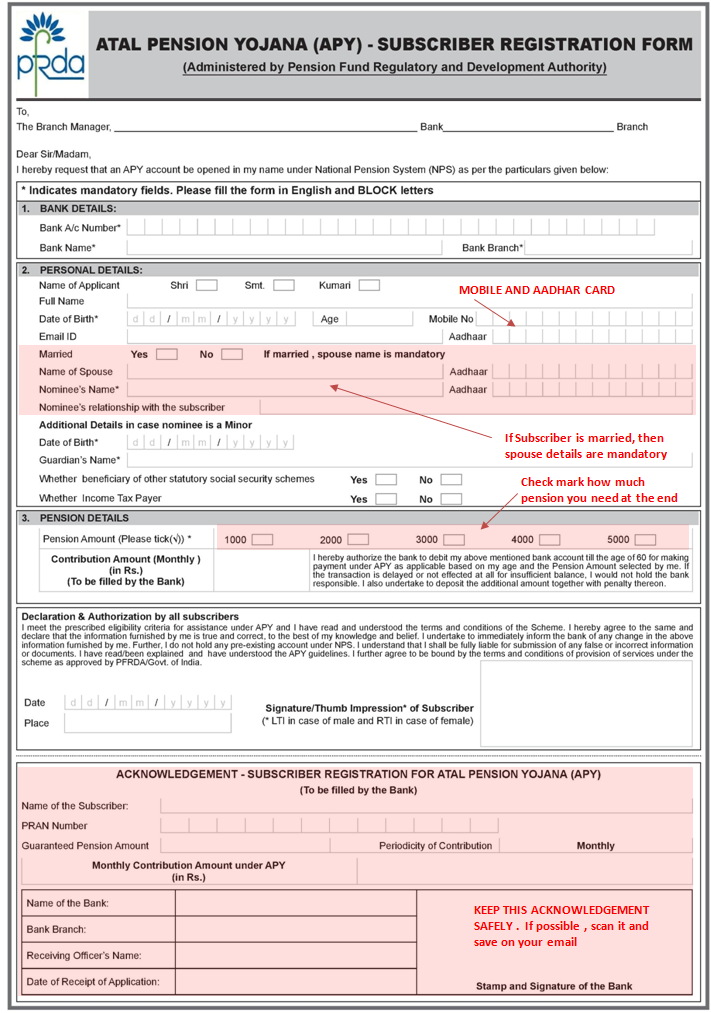

How to open Atal Pension Yojna Account?

- Go to the bank where you have your saving bank account like SBI, ICICI, HDFC or any other bank..

- Fill up the form (download english form or hindi form)

- Make sure you fill all the fields

- Mobile number is compulsory, hence that needs to be filled

- If you have aadhar card, provide the number in the form (but its not compulsory)

- You also need to provide spouse details if applicable and nominee details, which is compulsory

- You will select the pension amount you need in future and based on that the bank official will write the monthly contribution required on the form

Below is a sample form

Note that the form itself contains a section which mentions that you are authorising the bank to deduct the monthly contribution from your account till the age of 60 yrs. So once the account is opened, your account will then get auto debited in future every month. If one does not have a bank account, then one can give their KYC documents along with account opening form with the Atal pension Yojna account form.

Eligibility Criteria for Opening an account

- The age of the subscriber should be between 18 – 40 years.

- One should have a saving bank account or should open a new saving bank account

- One should be having a mobile number, which needs to be furnished at the time of filling up the form

Government co-contribution for 5 yrs

If one joins this scheme between 1st June, 2015 to 31st December, 2015 , the govt will co-contribute 50% of the total contribution or Rs. 1,000/- per annum, whichever is lower for the 5 yrs period from 2015-16 to 2019-20 , But this govt contribution will be available only for those who are not covered by any Statutory Social Security Schemes and are not income tax payers. What that means if that if you are an EPF subscriber, then you will not be eligible for govt co-contribution part.

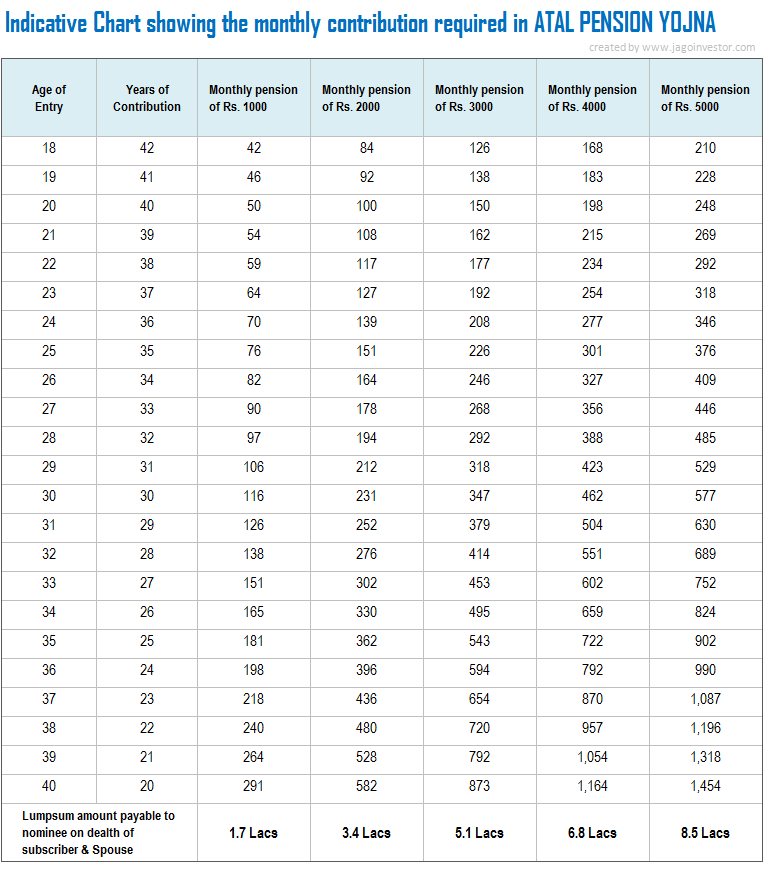

Below is the indicative monthly contribution required in this scheme at various age limits.

The subscriber can increase or decrease their contribution amount at some later stage if they want to do it

Will you get statements of transactions?

Yes, you will be getting regular intimations on your account information through SMS and even a physical statements each month. Note that you can move to any part of India without interrupting your contributions because the deductions will happen automatically from your bank account.

Can you exit or partially withdraw from the scheme ?

1. On attaining the age of 60 years – The first option is when you reach 60 yrs of age. At that time you will be able to use 100% of the money, but only in the pension form. You will only get the pension per month and not the lumpsum amount.

2. In case of death of the Subscriber (once they cross 60 yrs) – In case of death of subscriber, pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

3. Exit Before the age of 60 Years – The Exit before age 60 yrs, would be permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease. As per wikipedia, Terminal illness is a disease that cannot be cured or adequately treated and that is reasonably expected to result in the death of the patient within a short period of time. This term is more commonly used for progressive diseases such as cancer or advanced heart disease than for trauma.

What is your want to discontinue the payments or delay in payments ?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re 1 per month to Rs 10/- per month as shown below

- i. Re. 1 per month for contribution upto Rs. 100 per month.

- ii. Re. 2 per month for contribution upto Rs. 101 to 500/- per month.

- iii. Re 5 per month for contribution between Rs 501/- to 1000/- per month.

- iv. Rs 10 per month for contribution beyond Rs 1001/- per month.

Discontinuation of payments of contribution amount shall lead to following

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Are there any Tax benefits in Atal Pension Yojna scheme ?

No , there are no tax benefits available in this scheme. A lot of people might think that they will get any exemption under 80C or on maturity, but no benefits are available. The pension amount will be considered as the income for the person and will be added in the taxable amount.

What if someone is already a subscriber of Swavalamban Yojana under NPS ?

All the registered subscribers under Swavalamban Yojana aged between 18-40 yrs will be automatically migrated to APY with an option to opt out. However, the benefit of five years of Government Co-contribution under APY would be available only to the extent availed by the Swavalamban subscriber already.

This would imply that if, as a Swavalamban beneficiary, he has received the benefit of government Co-Contribution of 1 year, then the Government co-contribution under APY would be available only for 4 years and so on. Existing Swavalamban beneficiaries opting out from the proposed APY will be given Government co-contribution till 2016-17, if eligible, and the NPS Swavalamban continued till such people attain the age of exit under that scheme.

Note that, the ultimately the money under this scheme will be managed through NPS only and thats the underlying thing. All the investments decision will happen as per the guidelines of PFRDA.

A good support system for Poor

As I mentioned, this scheme has the maximum pension of Rs 5,000 per month, that too when the person reaches 60 yrs of age, that too will happen only after a minimum of 20 yrs from now (only people below 40 yrs of age can open an account), so Rs 5,000 at that time would be a very miniscule amount. However note that we are talking about the people in lower section’s who are really poor. At least this Rs 5,000 per month would be a great support in their old age when they won’t be working. A subscriber can open only one APY account.

With this scheme, people will be encouraged to save a small portion each month ranging from Rs 40 to Rs 210 per month. Below is the full chart showing how much money would be required to be deposited each month depending on the time of entry in the scheme and the pension amount chosen.

What is the returns of this scheme and should you invest?

So the question finally is, how good is this scheme and its returns if you consider the returns? I did a XIRR analysis of the scheme considering a 40 yrs old person is investing Rs 1,454 per month for 20 yrs , and then gets a pension of Rs 5,000 all this life (till age of 100 years). The returns I get is 7.74% through the excel sheet.

When I do the same thing for a 25 yrs old person invests Rs 376 per month for next 35 yrs (till age 60) and gets pension till he turns 100 yrs . The overall IIR is 7.9% . This includes the lump sum payment at the end to the nominee

So looking at the numbers, we can conclude that the returns from this scheme is in range of 7.5% to 8%. Considering that, Its a guaranteed return from govt of India, I will leave the judgement of its being good or bad to you only.

You should also read, Debasish Basu critical analysis of this scheme on this link to get more understanding about the issues of this scheme.

I would like to again reiterate the point that this scheme is more for the people of poor background who do not have access to any social security scheme already and will be somewhat beneficial for them, and not high-income earners because Rs 5,000 even after 20 yrs will be very very small amount. If one wants to still open this account, one should find a good enough reason for themselves.

Are you investing in this scheme?

I would like to know what you think of this scheme and if you will be opening an account for yourself? You can also suggest this scheme to your maid, driver or any person who you think should get a minimum pension by the time they turn 60 .

No comments:

Post a Comment